Bullion bars represent a significant investment option for those looking to preserve wealth, hedge against inflation, and diversify their portfolios. As a tangible asset with intrinsic value, bullion bars have been a reliable store of wealth for centuries. This article delves into the bullion bars essentials of bullion bars, their benefits, and key considerations for potential investors.

What Are Bullion Bars?

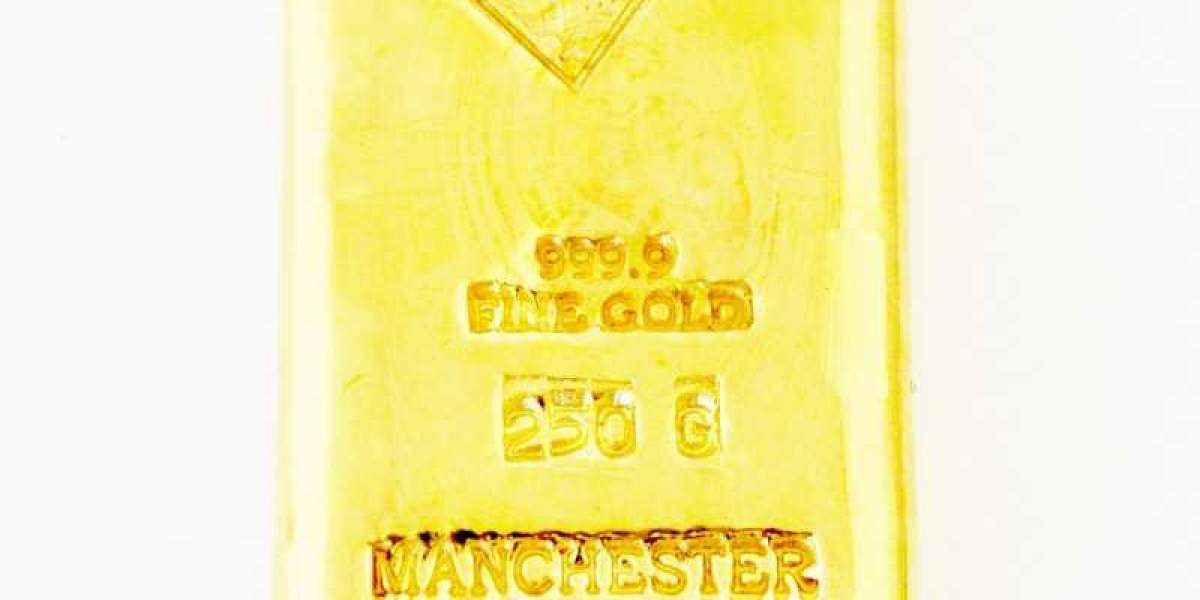

Bullion bars are refined precious metals cast into a specific size and weight. The most common types of bullion bars are made from gold and silver, although platinum and palladium bars are also available. These bars are typically 99.5% to 99.99% pure and are marked with their weight, purity, and often a serial number.

Benefits of Investing in Bullion Bars

Wealth Preservation: Bullion bars are a stable store of value. Unlike paper currencies, which can be devalued by inflation or economic instability, bullion bars maintain their worth over time.

Inflation Hedge: Gold and silver bullion bars, in particular, are often used to hedge against inflation. As the cost of living rises, the value of these precious metals typically increases, preserving the purchasing power of your investment.

Portfolio Diversification: Including bullion bars in an investment portfolio can reduce overall risk. Precious metals often have a low correlation with other asset classes like stocks and bonds, providing a counterbalance during market volatility.

Liquidity: Bullion bars are highly liquid and can be easily bought and sold on global markets. This liquidity ensures that investors can convert their holdings into cash when needed.

Tangible Asset: Unlike digital assets or paper investments, bullion bars are physical items that you can hold and store. This tangibility provides a sense of security and ownership that other investments cannot.

Types of Bullion Bars

Gold Bullion Bars: Gold bars are available in various sizes, from as small as 1 gram to as large as 400 ounces. They are widely recognized and traded globally, making them a popular choice for investors.

Silver Bullion Bars: Silver bars are also available in a range of sizes, typically from 1 ounce to 100 ounces. Silver is more affordable than gold, making it accessible to a broader range of investors.

Platinum and Palladium Bars: These metals are less common but offer unique investment opportunities. They are used in various industrial applications, which can influence their market value.

Key Considerations When Buying Bullion Bars

Purity and Weight: Ensure that the bullion bars you purchase have a high purity level, typically ranging from 99.5% to 99.99%. The weight of the bar should be clearly marked and verified.

Reputable Dealers: Buy from established and reputable dealers to ensure the authenticity and quality of your bullion bars. Look for dealers with positive reviews and industry certifications.

Market Prices: Monitor the market prices of precious metals to time your purchase effectively. Prices can fluctuate based on economic conditions, geopolitical events, and market demand.

Storage: Decide where you will store your bullion bars. Options include home safes, bank safety deposit boxes, or professional vault services. Ensure that your storage choice offers adequate security and insurance.

Certification: Ensure that the bullion bars come with a certificate of authenticity. This certificate should verify the bar’s weight, purity, and unique serial number.

Where to Buy Bullion Bars

Authorized Dealers: Purchasing from authorized dealers guarantees the authenticity and quality of your bullion bars. These dealers often provide buy-back guarantees, adding an extra layer of security to your investment.

Banks: Some banks sell bullion bars, offering a reliable bullion bars and secure purchasing option. This is particularly common in regions with a strong tradition of gold and silver investment.

Online Retailers: Reputable online platforms provide a convenient way to purchase bullion bars. Ensure the website is secure and check for positive customer reviews and ratings.

Gold and Silver Shows: Attending precious metal shows allows you to buy directly from dealers, often at competitive prices. This also provides an opportunity to physically inspect the bullion bars before purchasing.

Conclusion

Bullion bars are a timeless and prudent investment choice, offering stability, liquidity, and a tangible store of value. Whether you are seeking to preserve wealth, hedge against inflation, or diversify your portfolio, investing in bullion bars can provide significant benefits. By choosing reputable dealers, verifying authenticity, and considering secure storage options, you can confidently invest in bullion bars and secure a valuable asset for your financial future.